How To Start Investing In Stocks Uk – It can be difficult to know what to do with savings. Especially when interest rates are still at rock bottom. Here’s what you can do if you need to invest.

Deciding how to invest is not always easy. Should you save even though interest rates are low and inflation is unlikely to beat current levels? Should you gamble and invest in the stock market? The best place to invest generally depends on your financial situation.

How To Start Investing In Stocks Uk

When considering what to do with savings You must understand the difference between saving and investing.

How To Pick Stocks: The Complete Guide

Aging is something that makes you more passive over time. You can save money to buy or do something like a holiday or shopping spree. or a deposit for a new home or yours

You may want to save money so you have cash for a rainy day, such as when your car or boiler breaks down. Most people who save use a bank or social housing account that pays interest on their savings.

An investment is when you buy something that you believe will increase in value over time, such as real estate or stock in a business. The goal is to make a profit when you sell your investment. This is more of a gamble and more risky than saving in a bank or social savings account. You can make more money if you do well, but if you don’t, you can lose. That’s why you should never invest more than you can afford to lose.

Saving gives you the freedom to do what you want, as well as financial security in case of unexpected events.

Here’s Where I’ll Be Investing My Stocks And Shares Isa In 2023

In general, it’s a good idea to keep at least three to six months of living expenses on hold. It should be in a savings account that you can easily access. so that if something happens that prevents you from doing your job You will have a grace period of three to six months in between. where you can continue to pay the mortgage or rent buy food and more. It also serves as a handy emergency fund if something goes wrong in your home.

But not everyone should be saved. If you have a higher priority to focus on first things like paying off debt, you should be more likely to do these things before you start saving. If you have no debt to pay you should really save. If you don’t have debt but think you have a hard time saving. Using a budget planner can help you see where you can cut costs.

Before you start scrambling or figuring out how to invest. It is important that you first eliminate any outstanding debts you may have.

You’ll be charged more interest on most credit cards and loans than you would when you pay into a savings account. So use the extra cash to focus on clearing your debt before you start saving.

Best Investment Apps Uk For March 2023

Check if there are any restrictions. Or whether you can pay off each loan before the due date or not. This is because some fixed-term agreements include large early payment fees.

It’s a good idea to think about your goals before deciding whether to invest or save. You can decide whether to save or invest depending on whether your goals are short-term, medium-term or long-term.

What do you plan to do in the next five years? This might include booking a special vacation or buying a house or car. For short-term purposes should go to a savings account. Investing in the short term is not a good idea. because you might lose

What are you planning to do in the next 5-10 years for this kind of savings? Choosing between an investment and a savings account depends on how much risk you are willing to take to get a better return on your investment. Savings accounts are less risky. But you won’t earn much interest. especially at the current rate Investing is risky. But it should give better returns.

Best Active Investments To Earn Active Income In Uk 2022

What do you want to do 10 years from now, like retirement, for long-term savings? Your investment is often a better choice because you have a greater chance of making a profit. Although the value of investments such as stocks and shares can go down and up. But your total income should be better than the income from a savings account over a longer period of time.

Below we outline four options for using your savings. You might want to pick one or two. or if you have enough money to spare You might want to choose a combination of all four.

It’s a good idea to have at least some money in a traditional savings account. You can easily withdraw the cash you need in an emergency. So look for accounts that offer the highest interest rates while giving you the access you need.

If you are happy to lock in your lump sum for a certain period of time Fixed rate bonds or savings accounts tend to offer better returns than easy access accounts.

How Old Do You Have To Be To Invest In Stocks?

If you haven’t used your ISA allowance this tax year, it may also be worth opening an existing Cash ISA or top-up. For the 2021/22 tax year, the annual ISA allowance is set at £20,000.

The main benefit of an ISA is that you earn interest on your savings without having to pay income tax.

While basic taxpayers can earn interest on their savings of up to £1000 a year tax-free (thanks to Personal Savings Allowance), higher-rate taxpayers have a lower limit of £ 500. Personal Savings Allowance will not be given. Therefore, ISA is a useful saving tool.

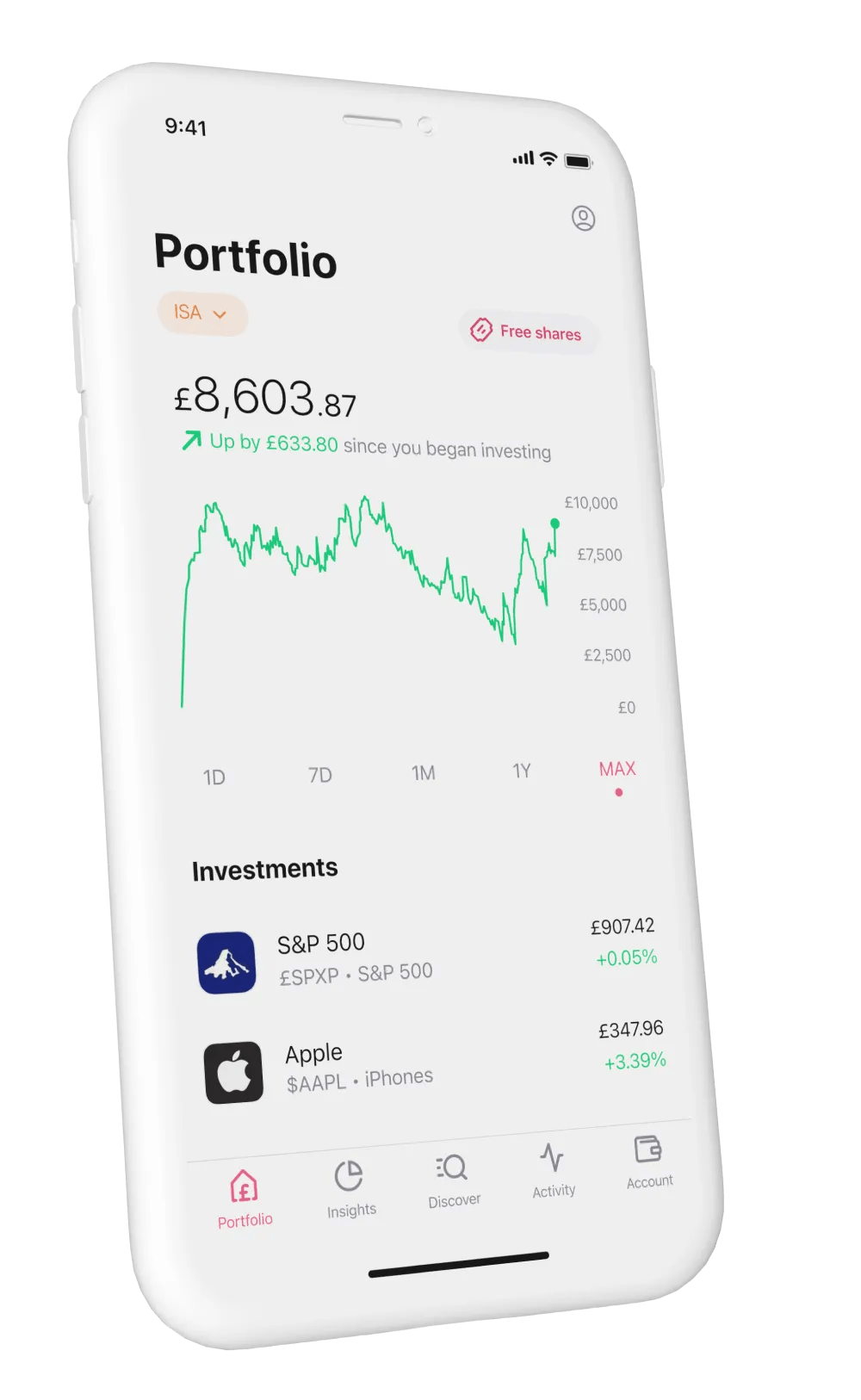

A Stocks and Stocks ISA (also known as an Investment ISA) lets you invest your annual allowance in an ISA in a tax-efficient way. and offers a simple way to start investing in the stock market

Beginner’s Guide To Stock Investing For Singaporeans

This can be used to invest your entire allowance – currently £20,000 – or as a percentage if you prefer. You can also split your allowance between a Cash ISA and a Stocks and Shares ISA.

If you have savings left over Another option is to use it to reduce your mortgage balance. This can save you hundreds or even thousands of pounds in interest.

Some mortgagors charge a penalty if you overpay more than a certain amount each year. So check your mortgage paperwork or ask your mortgage provider. But most mortgage servicers will allow you to overpay up to 10% of your balance annually without incurring a fee.

Even if your lender charges a fee But it may be worth it compared to the amount of interest you will save by making larger payments.

What’s The Best Time Of The Day, Week And Month To Buy And Sell Shares?

It depends on your situation and your current financial plan for retirement. You can use yours to create a pension fund.

Many people consider this to be the best way to invest for the long term. Because investing or saving a pension has a number of tax benefits. depending on your income These can increase the value of your retirement fund by up to 50%.

Knowing the best way to invest can be confusing. Investing is not a good idea in the short term. It’s a long game. But if you are comfortable with your cash tied up for at least 5 years, you can explore your investment options.

Remember that investing means that you are likely to be at risk, so even if you choose low-risk investments you also have to accept the fact that your value may decrease if your investment does not perform well.

How To Invest In The Stock Market

The more you invest The more you get, the more opportunities you get. But there are more chances to lose as well

No matter what type of investment you choose. Remember not to have ‘All your eggs in one basket’

Diversifying or dividing your investments into different categories This is a great way to protect yourself in case your investment fails.

If you want to know more about the best investment methods you should talk to a financial advisor. Expert advice can help you make informed decisions. Especially if you are new to investing.

How To Open An Investment Account With Trading 212

This investment option allows you to build your own stock portfolio. or part ownership of a particular company sold to raise funds

Stock trading allows you to buy and sell stocks of publicly listed companies using stocks and stock accounts. You trade individual company stocks directly.

The idea is to buy stocks when prices are low and sell them when their value is higher. The company sets the starting price. But after that, it is affected every day. This is because people buy and sell based on factors such as the economy and individual company performance.

But there are no guarantees. though you have more control But it’s also a riskier investment.