Best Personal Loans With Low Interest Rates – If you are looking for an expensive item, such as a car, you may need a loan to cover the cost. Personal loans and auto loans are two of the most common forms of financing. They can be obtained relatively easily, assuming you meet the appropriate loan requirements.

So what is the difference between them? A personal loan can be used for many different purposes, including buying a car, while a car loan (as the name suggests) is only for buying a car. Each type of loan has its pros and cons; it’s important to weigh and compare them before signing on the dotted line.

Best Personal Loans With Low Interest Rates

A personal loan provides a lump sum of funds from a lending institution (usually a bank) to a borrower who can use the funds at the borrower’s discretion, such as for a vacation, wedding, or home renovation.

Best Business Bank Accounts In Canada 2023

A personal loan can be secured by something of value, such as a vehicle or home, and if you default on the loan, the lender can seize your assets to cover losses. However, most people choose unsecured loans, that is, loans are issued without collateral.

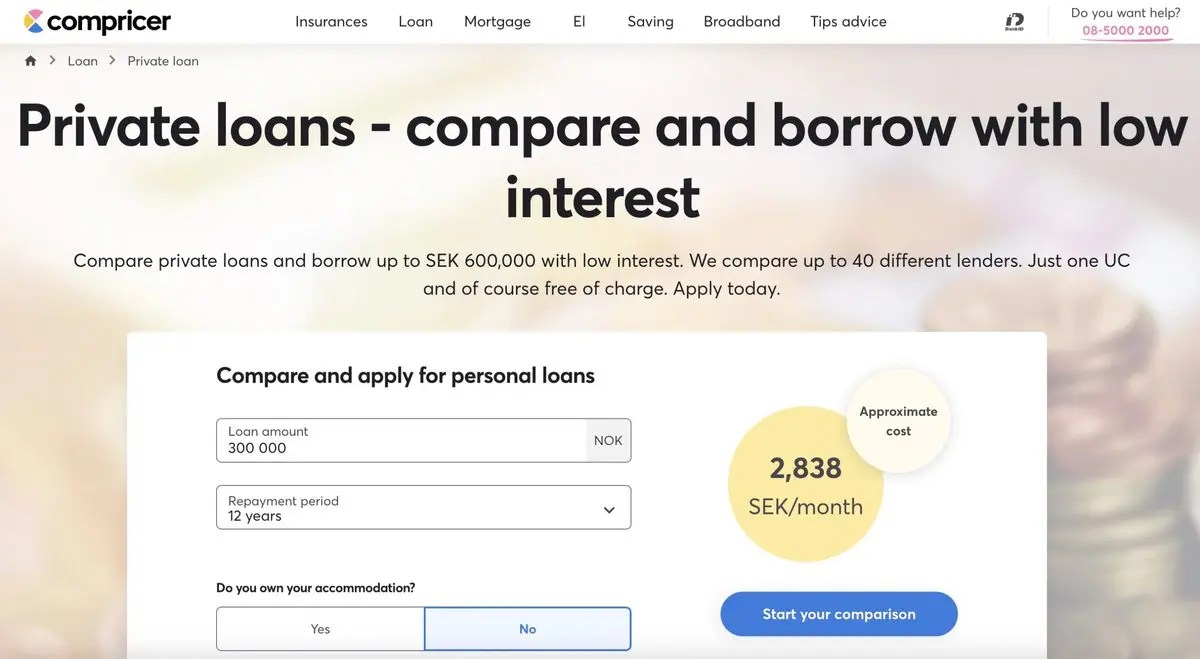

Two key factors that affect the total amount of the loan are the interest rate and the term of the loan. A personal loan calculator can be a useful tool for determining how these factors will affect your monthly payment.

In general, unsecured loans have higher interest rates than similar secured loans. Unsecured personal loans also have stricter approval requirements, so you’ll need good credit. If you are in poor health, a personal loan may not be an option.

Your credit score affects the loan amount and interest rate, which can be fixed or variable. The better your credit score, the better your borrowing capacity and the lower your interest rate. Conversely, the worse your credit score, the lower your ability to borrow and the higher the interest rate.

Questions To Ask Before Applying For A Personal Loan

Personal loans have fixed repayment periods, which are measured in months – 12, 24, 36, etc. A longer loan term will lower your monthly payment, but you’ll pay more interest over the life of the loan. Conversely, a shorter loan term means higher monthly payments, but generally less interest because you can pay off the principal sooner.

Most lenders accept online personal loan applications, and you can usually get approved for a car loan on the spot at a car dealership.

The collateral for a car loan is the car that you are going to purchase, that is, the vehicle is the collateral for the loan. The lender can repossess the car if you fall behind on your payments. The loan is repaid in fixed installments throughout the entire term of the loan. Similar to a mortgage, the lender retains title to the asset until you make the final payment.

To determine the best interest rate and loan term for your needs before heading to the dealership, try using a car loan calculator first.

Get Fixed Interest Rates On Loan For 5 Years Deals Of Loan

Since the lender has financial control over the car—it’s a secured loan—the debt is considered less risky, which often means much lower interest rates for the borrower. The interest rate is also fixed, so borrowers are not affected by the rate hikes associated with unsecured personal loans.

Most car loans are fixed for 36, 48, 60 or 72 months. Just like with personal loans, the shorter the term, the higher the monthly payment and vice versa. A below-average credit history doesn’t necessarily prevent you from getting a car loan (unlike a personal loan). It also has less of an effect on your interest rate or the amount you borrow, depending on the price of the car.

There are different ways to get a car loan. Before you apply for a dealer loan, it’s a good idea to find out if your local bank or credit union can offer you a better deal.

Whether you choose a personal loan or a car loan, rates and offers vary by institution. So do your homework and shop around for the best deal. Research banks, credit unions and other lending platforms to find the best combination of interest rates and loan terms for affordable monthly payments.

How To Get A Personal Loan: Rates And Fees

When buying a new car, many consumers choose a dealer-financed car loan because it’s quick and easy. But in some cases, it may be more efficient to get a personal loan. To make an informed decision, start by asking these questions:

Choosing between the two comes down to weighing the pros and cons based on your personal circumstances.

Writers are asked to use primary sources to support their work. These include official documents, government data, original reports and interviews with industry experts. We also cite original research from other reputable publishers where appropriate. You can read more about the standards we follow to create accurate and unbiased content in our editorial policy.

Offers that appear on this form are from compensation partners. This compensation may affect how and where the listing is displayed. Excludes all offers available on the market. Both personal loans and credit cards offer ways to borrow money and have the same standard credit terms. In loan and credit card agreements, you’ll typically find funds from the lender at a specified interest rate, monthly payments including principal and interest, late fees, underwriting requirements, amount limits, and more. Misusing any credit can hurt your credit score, leading to problems getting loans, getting quality housing, finding a job, and more.

How Do Personal Loans Affect Your Credit Score?

But in addition to the similar attributes of personal loans and credit cards, there are some key differences, such as repayment terms. Let’s explore the definitions and differences between them, as well as the pros and cons of each.

Before we dive into comparing the differences between personal loans and credit cards, it’s important to understand one important similarity. The United States and most countries have integrated credit scoring systems that are the basis for credit approval. The three major U.S. credit bureaus—Equifax, Transunion, and Experian—lead the way in setting credit scoring standards and working with lenders to obtain credit approval.

Credit scores are based on an individual’s past credit history, including credit defaults, inquiries, bills and outstanding balances. Everyone is assigned a credit score based on this history, which can seriously affect their chances of getting a loan. Taken together, all the factors that the lender considers also affect the interest rate that the borrower pays and the approved principal amount.

Both personal loans and credit cards can be unsecured or secured, which can also affect the terms of the loan.

Where To Get A Personal Loan

Paying off credit card balances and paying off personal loans on time helps boost your credit score.

Lenders offer a variety of options in the personal loan category, which can affect the terms of the loan. In general, the main difference between a personal loan and a credit card is the long-term balance. Personal loans do not provide permanent access to funds like credit cards. Borrowers receive a lump sum upfront and have a limited amount of time to repay it in full through regular payments before the loan is repaid. For borrowers with good or high credit ratings, this arrangement usually results in lower interest rates.

Personal loans can be used for several reasons. Unsecured loans can provide funds to finance a major purchase, consolidate credit card debt, repair or upgrade a home, or provide funds to fill a gap in income. Unsecured loans are not secured by the borrower’s collateral.

Home loans, auto loans, and other types of secured loans can also be considered personal loans. These loans will go through the standard loan approval process, but may be easier to get because they are secured by assets.

Best Personal Loans Banks In Bangladesh

For example, in a home loan or car loan, the lender has the right to repossess your home or car after a certain number of delinquencies. Secured loans usually have slightly better terms because the lender has title, which reduces the risk of default. Here are some advantages and disadvantages of personal loans.

Remember that interest is not the only fee to consider when taking out a loan. Lenders also charge a fee that increases the total cost of the loan. Personal loans usually include an origination fee, and there may be other fees as well.

It is worth noting one difference between a line of credit (LOC) and a loan. Unlike a loan, a line of credit has built-in flexibility — and that’s its main advantage. The downside is that it usually comes with a higher interest rate.

An LOC is a pre-set loan amount, but the borrower is not required to use all of it. Borrowers can draw on the line of credit at any time as long as the terms of the line of credit and other requirements, such as timely minimum payments, are met.

Best Personal Loans Online For Bad Credit Guaranteed Approval 2023

LOCs can be protected or unprotected (mostly the latter) and are

Personal loans best interest rates, small personal loans with low interest rates, large personal loans with low interest rates, low interest rates personal loans, personal loans at low interest rates, personal loans with low interest rates, interest rates personal loans, personal loans online with low interest rates, best low interest personal loans, low interest rates for personal loans, personal loans with low interest, personal loans with low interest rates for bad credit