How Much Does Visa Charge Businesses – Both Visa and MasterCard recently agreed to drop their no-surcharge rule, leaving businesses free to pass those fees on to consumers. (shutter stock)

Lawrence Ashworth does not work for, consult with, own stock in, or receive financial support from any company or organization that benefits from this article, and has disclosed no relevant affiliations beyond his academic appointment.

How Much Does Visa Charge Businesses

Canada has one of the highest exchange rates in the world. Interchange fees are fees that businesses pay each time their customers pay with a credit card.

Credit Card Frequently Asked General Questions

While the average exchange fee in Canada is about 1.5% of the transaction value, fees typically fall between 1% and 2.5%. The composition of these fees can be complex, but usually ends up with the issuing bank. Credit card networks receive a lower volume of transactions.

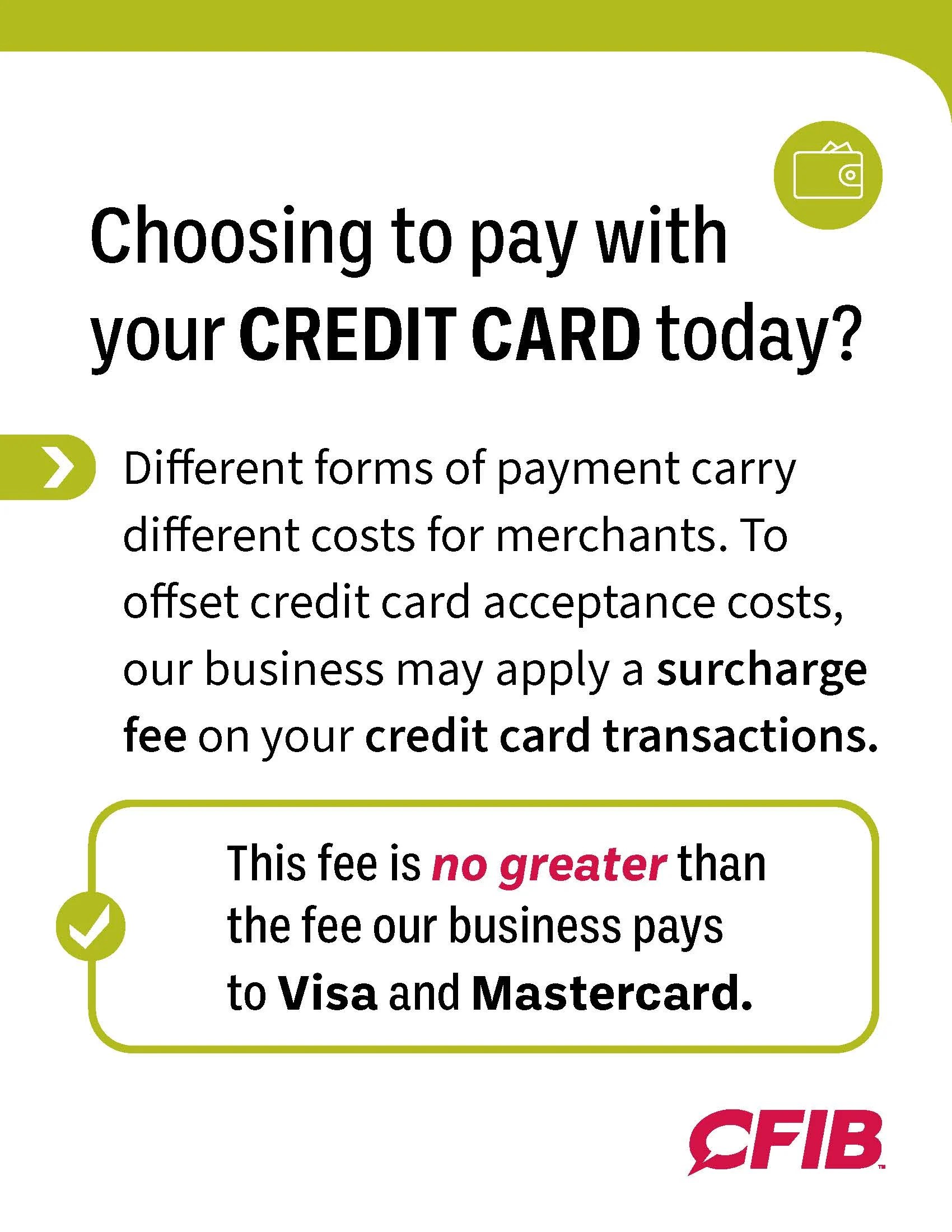

Until last month, credit card networks did not allow businesses to pass these charges on to consumers. That recently changed with the settlement of a class-action lawsuit alleging that some banks and credit card networks conspired to set high interchange fees and prevent businesses from adding extra fees or denying high-cost cards.

Several Visa and MasterCard banks have admitted no wrongdoing but have agreed to contribute to a $188 million settlement fund that will be distributed to Canadian businesses that have accepted Visa or MasterCard since 2001.

In response to the lawsuit, Visa and MasterCard agreed to drop the no-surcharge rule, leaving businesses free to pass the interchange fee on to their customers. For example, on a $50 purchase, customers may pay up to $1.25 in additional credit card fees.

Average Credit Card Processing Fees And Costs In 2022

So, what does this mean for Canadian consumers and businesses? Now that businesses are allowed, will they add additional fees to cover credit card fees or continue to charge fees? What do businesses need to know about customer reactions to surcharges? And what are the additional costs and benefits of credit cards for consumers?

To help businesses predict consumer reactions to credit card surcharges, we can turn to behavioral economics, which combines elements of economics and psychology to understand how and why people behave in the marketplace.

Behavioral economics has long observed that people show strong discounting reactions to both losses and gains. This means that, for example, the pain of a $10 loss is one-tenth the pain of a $100 loss. An additional fee increases the “pain of paying” compared to including the fee in the overall price.

No one blames businesses for adding taxes, but consumers are likely to blame businesses if they add additional credit card fees. (shutter stock)

Can A Business Charge For Using A Credit Card?

England. As a teenager working in our family’s furniture business, I remember a time when a customer angrily threw his credit card at me after my mother informed me of an overcharge on our credit card. But the psychology of losses does not give a complete picture here – they are the reason for the anger of consumers.

This is the answer that businesses should rightly fear. Blame dramatically increases the perception of injustice. No one blames businesses for adding taxes, but consumers are likely to blame businesses if they add additional credit card fees.

This means that consumers are unlikely to support additional credit card fees, especially if they are added to existing prices. In fact, the UK banned credit card surcharges in 2018, on the basis that surcharges are simply ‘drop-off charges’.

While businesses can speculate about how consumers will react to additional fees, it’s difficult to fully predict. To make it safer, most businesses in Canada now refuse to add additional fees to credit card usage.

Stolen Credit Card Info Used To Defraud Edmonton Businesses $250k

According to a survey by the Canadian Federation of Independent Business, most businesses don’t plan to add additional costs (15 percent), aren’t sure if they should (40 percent), or follow what others in their industry are doing (26 Percent). One in five businesses (19 percent) said they plan to use surcharges.

For businesses thinking about using surcharges, there are better ways to implement them than simply on existing prices. One approach is to reframe the situation for customers by offering cash or cash discounts instead of adding additional fees to credit cards.

For the same reason that a separate credit card surcharge increases the “pain of payment,” adding a discount—often seen as a small, discrete benefit—can have a significant impact.

Instead of adding extra fees to credit cards, businesses can offer discounts to customers for paying with cash or cash. (shutter stock)

Common Credit Card Fees And How To Avoid Them

While prices are adjustable and the process is essentially the same as credit card surcharges, cash rebates less than surcharges are considered unfair by credit card users.

A second option is for businesses to lower their prices before adding an additional fee to ensure that customers are aware of the price reduction. As long as customers understand that the business has first made efforts to lower prices, credit card surcharges are considered fees.

If implemented correctly, surcharges have the potential to improve consumer decision-making by allowing consumers to make better decisions about their credit card use.

Credit cards provide cost benefits to consumers. In exchange for facilities, credit, rewards and other benefits, customers pay an annual fee, interest and – on prices – transaction fees.

Small Business Riled By Credit Card Fee Deal

Currently, significant interchange fees are hidden from consumers, meaning consumers do not fully calculate the cost of their decision. Not only that, but customers paying with cash and debit cards can’t avoid transaction fees when businesses are forced to include them in prices, even if they receive no benefits.

Credit card surcharges allow consumers to avoid spending if they don’t perceive enough benefits. In other words, surcharges or cash rebates help consumers make better decisions and allow them to properly calculate the costs of using a credit card.

Write an article and join a growing community of 162,100 academics and researchers from 4,590 institutions. Visa Inc ( V ) is one of the leading global payment brands, as is its cousin MasterCard ( MA ). Visa provides payment services to more than 200 different countries from consumers, merchants, finance and governments.

Visa offers a wide range of services to merchants and financiers, including authentication, clearing and settlement. Fun fact, Visa does not offer any debit or credit cards. Instead, the cards come from its clients, such as JP Morgan and PayPal.

Can My Business Avoid Credit Card Processing Fees?

Visa makes money by selling its services as an intermediary between merchants and financiers. Unlike American Express or Wells Fargo, Visa does not earn income from credit cards.

Visa is one of the most powerful global brands. It started as one of the first credit card programs in the 1950s and has grown into a global giant by creating a network and protocol that allows for the easy transfer of money between parties globally.

Learning how one of the global leaders in payments makes money helps us, as retail investors, understand how we can benefit in the payments sector with others like PayPal, Square and Stripe. Studying some of the best jobs in the world is good, not only does it help us analyze others in the same field, but also others outside of payments and finance.

Visa’s mission statement is to “connect the world through the most innovative, trusted and secure payment network – empowering people, businesses and economies”.

A Huge Issue’: Canadian Merchants Are Now Paying Billions More To Accept Credit Cards — And They’re Asking For Help

Visa is a perfect example of a “multifaceted platform”. The Visa platform creates network effects by attracting Visa cardholders to use more, which in turn encourages greater merchant adoption and keeps the wheels turning. We can consider merchants on the money side and consumers on the subsidy side of the equation. Visa spends most of its efforts promoting consumer use, which drives merchant adoption.

In 1973, Visa developed a revolutionary payment protocol called VisaNet. The goal was to provide a better way to pay globally. And fifty years later, he succeeded in his goal.

Banks use the VisaNet payment processing protocol to develop and create credit card and debit card applications for their customers. As I mentioned earlier, Visa does not offer a credit or debit card on its own. It is done on the banking side.

Instead, Visa operates an open-loop payments network to manage the flow of payment information between merchants and financial institutions such as JP Morgan.

B2b Payment Methods For Small & Large Businesses

To confuse matters, sometimes the buyer can also be the distributor. For example, JPMorgan processes payments by issuing debit and credit cards to account holders.

New players like Square and PayPal offer both sides of the equation, buyers and exporters, with Cash Cards (Square) and Cash Card (PayPal) programs. For example, others in the payment processing or Payfax space such as Stripe, Aden, Fiserve and FIS are strictly business acquirers because they do not issue cards.

Payment flow when issued by the cardholder

How much does visa charge merchants, how much does redfin charge, how much does paypal charge businesses, how much does allsup charge, how much does groupon charge businesses, how much does yelp charge businesses, how much does vrbo charge, how much does angie's list charge businesses, how much does yelp cost for businesses, how much does visa charge per transaction, how much does visa charge, how much does visa charge vendors